Well, after a few breaks from my inundated, unavoidable family and life obligations and the time-effort they required, I have finally finished and posted Part IV! Thank you for your patience and understanding these last four months.

Previously in Part III we learned that the higher and wider the gap of inequality in the United States, the more extreme, converse abuses and crimes its population will engage and endure. America’s corporate world dabbles in, even thrives off of this inequality and distress and often yields to the temptations of the more profitable grey market which is never far removed from the black market—in several cases the two are indistinguishable. In this Part IV I want to burrow into five of at least fourteen specific markets or tentacles that comprise the insatiable beast called BU Inc.

∼ ∼ ∼ § ∼ ∼ ∼

Illegal Gambling & Games

The sole reason illegal gambling and gaming take place in the U.S. or by way of the U.S. is its highly lucrative profits without any taxation. “Each year, it is estimated that casinos and sports-books in Nevada pay $868.6 million in taxes” says Casino.org an online casino guide website. Imagine if those gambling-gaming houses could keep that money. The combined illegal gambling-gaming market is reportedly a $67 – $380-billion dollar industry, a tax free industry. Too many American citizens and businesses, whether law-abiding or not, seem to not want to pay taxes or their legitimate fair share of taxes. Why?

There are perhaps four generally popular, risky or life-threatening gambling-gaming activities in the U.S. Street racing packs high-speed, oil, carbon-monoxide and rubber for an adrenaline high and big money for winning crews and driver. Though illegal high-stakes racing is on the rise across the nation, Southern California is the epicenter. There is typically a race or races every night. If caught, drivers can sit in jail for up to 90-days; a small price to pay (in their minds) given the huge rewards of winning, upwards of $20,000+ in some big races. Reaching 100 MPH in about 6-seconds then over 130+ MPH in longer races, they do it for street respect and a winner-takes-all prize. But it can be at the expense of pedestrian bystanders and other non-participating drivers caught in the middle of chance “takeover” races they were oblivious to. Only a small group of drivers and fans know about the when and where of races. Injured or killed pedestrians are simply in the wrong place at the wrong time. For more, read Out of Control by the L.A. Times.

Cock-fighting and dog-fighting in the U.S. have become lucrative illegal games of gambling the last 25-years. The ASPCA states in their A Closer Look at Dog Fighting report Why Do People Get Involved with Dog-fighting:

There are many reasons people are drawn to dog-fighting. The most basic is greed. Major dogfight raids have resulted in seizures of more than $500,000, and it is not unusual for $20,000 – $30,000 to change hands in a single fight. Stud fees and the sale of pups from promising bloodlines can also bring in thousands of dollars. […]

For others, the appeal simply seems to come from the sadistic enjoyment of a brutal spectacle.

Cash confiscated from an illegal gambling ring in Nashville, Tennessee. (Source: wsmv.com)

Today elaborate and extensive breeding techniques for hostile/killer animal bloodlines with very basic, crude genetic education has turned cock- and dog-fighting into a thriving and growing million-dollar black industry.

Finally, there is the widely popular, fanatical and illegal Sports betting in and by way of the U.S. Currently sports betting is an approximate $150-billion per year illegal market according to the American Sports Betting Coalition. This year in 2019 there is a race by some 20+ states to make sports gambling legal, regulated, and to take chunks out of wagers and winnings for state tax-revenues. Gamblers and underground gambling-gaming houses are fighting these changes; they do not want to give up more of their “profits.” This means there will likely always be illegal sports betting in the U.S. to evade state and federal taxes. This creates more problems. A large sector of America, mostly the economic upper 20% – 30% do not want to pay their taxes. Therefore, this breeds and sustains black markets such as sports gambling and affiliate laundering markets.

Phony Pharma

The majority of American prescription drug patients want or need their pharmaceuticals for one or two reasons: 1) they must have them to survive their chronic medical issues and illnesses, and/or 2) the cost to patients and insurers fluctuates relative to economic variables throughout the entire chain of manufacturing, from research, to FDA approval, to production and distribution, to end-user and their insurance coverage, semi-coverage, or no coverage. The fact will always remain, everyone in that entire pharma chain affects all the others. Period. Legislatures must factor their policies with all six phases in mind.

When it comes to a matter of life or death, or even getting by until something improves, legally or not, patients or end-users will do whatever it takes to survive. Common medicines such as inhalers, antibiotics, or insulin for diabetes are rarely affordable. Those three widely used meds for chronic illnesses are a very small part of America’s health problems overly managed by pharmaceuticals. Just a one-month supply of legal legitimate insulin costs $900 at the pharmacy. Between 2002 and 2013 legal insulin prices tripled that. According to a February 2019 Fortune.com article:

According to a survey by the Commonwealth Fund, just 12.4% of Americans ages 19 to 64 are uninsured, a rate the Commonwealth Fund notes is statistically unchanged since 2016 despite efforts by the Trump administration to weaken the law.

But the number of underinsured Americans has steadily climbed, increasing from approximately 29 million in 2010 to 44 million in 2018. Underinsured is defined by those whose out-of-pocket costs or deductible comprise 5-10% of their income. These individuals find it more difficult to cover their medical bills, which can often turn into debt.

As healthcare and pharmaceutical costs remain fairly steady, or higher, and/or rising, millions of Americans are increasingly underinsured. These are a handful of causes for a thriving black underground phony pharma market. With demand on the rise exponentially, a demand now higher than heroin, this illegal trade has gotten uglier and usually the consequences are deadly, immediately and in the short and mid-term.

A vast number of phony pharma dealers and distributors risk their liberties and rights as “free” citizens and going to prison if caught in order to deliver patients their life-giving prescriptions—prescriptions they otherwise could not legally afford due to insurance denials and/or deductibles nor the mandatory health guidelines of obtaining prescription refills, i.e. the monthly or bimonthly doctor checkups, tests, etc. Those checkups are by no means cheap for further additional reasons. And as law-enforcement clamps down on this illegal business, they push it further underground. In turn, black market prices rise, then more ruthless criminal opportunists get involved for the higher profits. Despite good intentions of sons, daughters, nieces or nephews making Robin Hood pharmacy deliveries for family and friends, consuming or injecting unregulated, untested medications from producers sold without the licensed experienced permission of a medical doctor and staff puts the user at high risk for overdose, misuse, and severe side-effects or permanent damage, sometimes death.

Many self-made self-taught pharmacists setup their own chemical labs, mix-up and package their own knock-off meds that are in high demand. For example, many of the aforementioned chronic illness prescriptions above stimulate a rise of homemade pharma labs. Their kitchens become a mini-production line based on internet printed recipes of chemical ingredients, volumes, weights, and procedures making a sketchy cheaper consumer street-product. But very high profit margins for kitchen-pharmacists in a high-demand American society who cannot get enough pills and vials for every type of discomfort, pain, relaxation, or pleasure make all the risks worthwhile to improve their own economic distress.

Human Trafficking

For migrants entering illegally from Central America through Mexico to the U.S., surviving the days and nights in the desert is daunting, exhausting, and sometimes lethal. Yet, to flee the escalating violence in their native country they’ll pay Coyotes up to $5,000 upfront for ‘protection’ and a one-way attempt across the border. Along the way immigrants also face extortion, pathetic conditions, while young females are sometimes forced into global prostitution. For more detailed reports click here and here. If they make a successful entry across the border and get to their final, main hub like Phoenix, Tucson, Los Angeles, San Diego, San Antonio, or Houston, the gang/cartel extorts another large fee of up to $3,500 – $5,000 for “employment hookups” with corrupt American business owners. More on this later.

For over two decades street gangs and crime syndicates or cartels have taken over the billion dollar human smuggling operation into the United States. The entire chain of illegal immigration from origin, to stash-houses (holding as many as 150 people in small 2-bedroom homes with no plumbing or electricity), to the next hub-transfer, to more stash-houses, to final destination, gangs, grey business groups, and cartels… here in the U.S. each are extortion setups for cash percentages. Everybody takes their large cut.

Over 62 illegal immigrants living in a Houston, TX stash-house for several weeks, 2017 – photo by U.S. I.C.E.

In a 2015 National Geographic investigative documentary, a 26-year old U.S. small business owner/contractor in Phoenix, AZ nicknamed Vicente, who has perfect English, told journalists how lucrative human trafficking works on the American side of the border:

As long as there is a hard border with a wall, no wall, threats from this President or that President, I.C.E, law-enforcement like Border Patrol, and an endless demand by American business owners wanting cheaper, cooperative, no hassles, blue-collar workers accepting minimum wage or less to work 12-16 hour days, and for no job health benefits, my life and family are good!

In fact, the harder the U.S. government makes it to cross, the more money I can demand and make! They keep me in business. And in D.C. when they demand less government intrusion into businesses and work operations, pass laws for more lax regulations and enforcement, that makes my job and money easier! [Vincente chuckles] Yeah, I’d be STUPID not to make fat cash like this. All the other American-born “taxi drivers” or human wranglers [also business owners/contractors] here I know have been doing this for generations. And this is just Phoenix! In the larger cities they rake in 2-3 times as much as I do! I want a piece of that American dream just like anyone else here… or coming here. To be honest, that dream is really a nightmare on BOTH sides of the border. But damn it sells; and for just about any amount.

Now that gangs and cartels are involved in every part of trafficking immigrants from origin to U.S. destination, any migrant that can’t pay or causes problems, gangs like Barrio 18 in Guatemala or Honduras will threaten or kill their family members back home until the debt is paid in full. When the operation goes difficult or bad, money is not the only tender—children or teen-girls are bartered throughout the gang/cartel systems as sexual commodities.

Regarding those aforementioned “employment hookups,” I personally have two cousins (Caucasian of course) near Austin, TX that have been in all aspects of the business-residential construction industry for all their lives—started out as 17-year olds with uncles. By 34 and 36 years old, they had their own official contracting businesses, one in plumping & electric, the other in residential and commercial landscaping. Both eventually progressed financially up into storage-unit facilities (several different locations), in particular RV & Boat storage for the highly popular, recreational lakes of Lake Travis, Lake Marble Falls, and Lake Georgetown. These three areas, as well as West Lake Hills and Rollingwood, are some of the wealthiest zip codes in the U.S., and certainly in Texas. My cousins are both in their early 50’s now and fully retired from their 30-years of work, the last 10-15 managing their hired supervisors. By the way, my cousins both speak decent Spanish, their “supervisors/foremen” are always bilingual.

After many family reunions that take an entire day to socialize, eat, drink, socialize more, eat more, drink more, and perhaps some games or dancing, I overheard and learned firsthand from these two cousins the tricks-of-the-trade and their yellow brick road to fortune and the high-life. Their success, fortune, and retirement was really made when they owned their contracting/sub-contracting businesses in construction and landscaping, most of it on the sweat and backs of a Hispanic labor-force who almost always accepted low wages (compared to Caucasian workers) and who demanded no health benefits for themselves or families. Wages and salaries, much less benefits, were NOT one of their biggest business expense. One reunion when asked indirectly how he avoided immigration problems he replied with a grin,

Who tha hell wants more government!? As long as we have under-staffed and under-funded State and Federal labor and immigration agencies (led by some we know personally) or are virtually non-existent agencies and staff that I don’t want to pay taxes for and try not to, and Texas stays Red and/or D.C. has a Red Administration and Congress, there’s no worries—the economy is great! [he winked and smiled]

Needless to say, I didn’t need to ask what party-ticket he always voted for and supported. Just two more native Texans/Americans that fuel this ugly, inhumane BU Inc. For the appalling reality of official statistics, go here: The Facts of Human Trafficking. For an investigative look into human sex-trafficking going on inside the United States, like Phoenix, AZ, also a hub for illegal migrants, watch PBS Frontline Sex Trafficking in America.

Ghost Guns

When economic inequality is rising or high, other social and criminal problems follow. Street gangs, pimps and international drug cartels require untraceable guns to enforce their activity. Enter the booming black market of ghost guns: an illegitimate exact replica that has no ballistic record and has never been serialized. Hence, governments and law-enforcement have no records, and background checks on buyers are completely bypassed. For felons with history and illegal operations this is the only means of acquiring weapons. With recent technology in metal-milling just about anyone over the age of 12 can now make firearms at home. This is exactly what 17-year old Alwin Chen built himself and regularly carried inside his Clarksburg High School in Maryland.

Imagine for a minute that you are born into a very impoverished, violent crime-ridden neighborhood anywhere in the world, including the highest violent-crime cities in the United States like St. Louis, MO, Detroit, MI, Baltimore, MA, and Memphis, TN (2017 stats)… the nation’s top four lethal metro areas respectively. Economic, occupational, and mental-illness programs are either non-existent or extremely under-funded and under-staffed. This leaves most all residents with very few legitimate options to earn enough to pay rent and utilities just to barely get by. The more convenient choices for better money (but with a low education-level) are illegal choices. For a 13-year old Guatemalan boy whose parents and siblings were threatened or executed by street gangs and drug cartels, if he didn’t work for them, what would you do to save the lives of your family?

Street and drug gangs in corrupt, poor, violent Central American countries as well as in Mexico and the United States, e.g. Fresno, CA, home of the Fresno Bulldogs, usually buy with their Black Underground earnings ghost guns or “burner guns” to protect, maintain, and enforce their illegal business operations against other cartels/gangs and law-enforcement. Homemade ghost guns today are now the gang’s and syndicate’s bread and butter, their Savior of convenience with no serialization or backgrounds. Clean weapons.

Wealthy, well-supported pro-gun, 2nd Amendment fanatics, retailers, gun-shop owners, and national weapons organizations all lobby heavily in Washington, D.C., to keep regulation of weapons and weapon-sales to the “general public” either non-existent or very minimal/lax. When all the past chronic gun problems and legal issues of weapons manufacturing fade away—because producing them in your home-garage, or inside the cartel’s and hidden warehouses/stores of street gangs is too easy, more profitable—ghost gun milling will (and has already started) replace such traditional brand-names as Smith & Wesson, Heckler & Koch, Sig Sauer, Colt Defense, and many others. The only effective defense against such a future, extensively weaponized, trigger-happy armed society will be a total ban on gun-part sales.

Sadly, even a drastic nationwide ban on the sell of gun-parts won’t stop home-made produced weapons getting into the hands of 13-year old boys from extremely destitute families, homes, and neighborhoods or violent gangs and cartels, no matter what country is poor or wealthy, corrupt or compassionate, civilized or uncivilized. The genies will be out of the bottles. They will be near impossible to put back in unless Congressional countermeasures are swift and atomically comprehensive.

Human Organ Trade

Of all the fourteen tentacles of this Black Underworld market, the human organ trade is one of the most despicable black markets in existence for me personally. But for desperate impoverished people, severe desperation causes people to do unthinkable desperate acts. Once again, gross economic inequality creates yet another inhumane market: the buying and selling of human body-parts. Whether the donor is alive and consenting or not, doesn’t necessarily matter to the business dealers.

Of all the fourteen tentacles of this Black Underworld market, the human organ trade is one of the most despicable black markets in existence for me personally. But for desperate impoverished people, severe desperation causes people to do unthinkable desperate acts. Once again, gross economic inequality creates yet another inhumane market: the buying and selling of human body-parts. Whether the donor is alive and consenting or not, doesn’t necessarily matter to the business dealers.

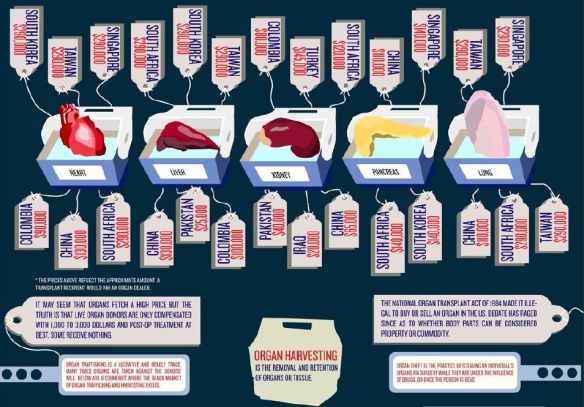

With legal supply unable to meet demand, the black market organ trade is thriving, and crime syndicates with global reach pocket millions from the desperately poor. Kidneys and livers grab some of the highest dollar amounts because they are 2-of-5 organs most vital to sustained life.

According to the World Health Organization:

The international organ trade links the incapacity of national health care systems to meet the needs of patients with the lack of appropriate regulatory frameworks or implementation elsewhere. It exploits these discrepancies and is based on global inequities. Accordingly, the growth and regularization of the international organ trade should be regarded as a global public health issue.

What part does the U.S. play in this global public health issue? The 2009 arrest of 44 people in New Jersey working in and knowingly benefiting from trafficking human organs shined a dark light on a growing, gross exploitation of health and economic inequities, in the U.S. and around the world. Wealthy patients pay top-dollar for organs from poor third-world residents and the 2009 arrests revealed only one out of many crime-rings of organ brokers operating within our country. Levy Rosenbaum, a rabbi in Brooklyn, NY and Finder-Middleman between donors, surgeons, and recipients boasted to the FBI agents he had been operating in this market for over 10-years. After serving about 2-years in prison, Rosenbaum was released.

Why would anyone get involved in this black market of human body-parts? The graphic below illustrates why.

Dr. Nancy Scheper-Hughes of the Dept. of Anthropology at the University of California-Berkeley is perhaps the most renown advocate and activist against human organ trafficking. In an April 2016 interview, Dr. Scheper-Hughes stated:

…some of the U.S.’s topmost medical facilities have been caught with illegally trafficked organs. Scheper-Hughes has tracked organs to hospitals and medical centers in New York, Los Angeles, and Philadelphia, among other places. At one point, she found herself across the table from a group of organ transplant surgeons at a top Philadelphia hospital.

In the shadows of these transplant operations are the organized crime syndicates using many deceptive illegal scams. Sometimes they’ll convince the target they have a (false) medical issue, get them to a clinic, put them (forceably?) under anesthesia and remove the organ(s) they seek. Other means are promising a large cash payoff and some aftercare treatment… but after its removal. Then they short-change the donor and offer no rehab afterwards. In most of these 3rd world countries, the poor and powerless can do nothing.

Once the syndicates have the fresh organs, they fetch anywhere between $20,000 to $200,000 per organ depending on its destination country and wealth of the patient. The donors rarely receive $5,000 for their naivety. Organ brokers deal with anyone around the world and put them in touch with “broker-friendly” surgeons and hospitals in developed countries like the U.S., Canada, or China… wherever top-dollar is acquired. Many U.S. hospitals and doctors, says Scheper-Hughes, either ignore the organ’s point of origin or how, they simply don’t ask, or pretend the black organ trade doesn’t exist. Many doctors and hospitals knowingly get involved for the big cash-payoff, which in turn requires “experts” in laundering that income. They often justify/defend their illegal behavior, like Levi Rosenbaum remarked, by stating How is saving a life a crime?

Perhaps one of the most maligned, indignant defenses or justifications for participating in and promotion of organ trafficking is conveyed by author and investigative journalist Alison Weir regarding Scheper-Hughes’ assistance in the 2009 New Jersey arrests:

When the [New Jersey] events became public, [Scheper-Hughes] said that much of the world’s illicit traffic in kidneys could be traced to Israel. In a 2008 lecture, she is reported as identifying two motivations of Israeli traffickers as “greed” and “Revenge, restitution—reparation for the Holocaust.” She is reported as describing speaking with Israeli brokers who told her “it’s kind of ‘an eye for an eye and a tooth for a tooth. We’re going to get every single kidney and liver and heart that we can. The world owes it to us.’”

∼ ∼ ∼ § ∼ ∼ ∼

In my final part five, the Conclusion, I want to further explore how chronic poverty and socioeconomic inequality (America’s desperate and/or homeless) is not only a petri-dish for extreme exploitation of the needy and Have-nots by the criminal Black Underworld as we’ve seen in these four parts, but more importantly in the end, in the long-run, costs everybody in a town, community, state, and nation—especially the U.S. with its exorbitant wealth among the top 10% of its population—no matter your social-economic class, status, or public image! You cannot buy yourself out of it or buy exclusivity from it. Everybody ends up paying for the cumulatively self-perpetuated crime, despair, and poverty in one way or another. Period.

I hope you’ll stay tuned for the Conclusion. Meanwhile, please do share any thoughts or questions in the comment-section below. Thanks.

————