It is astonishing as well as alarming! Doha, Qatar, one of many “Emerald Cities” in the Persian Gulf springing up from hot sand into vast riches of oil and gas then spectacular skyscrapers is since the early 2000’s, mostly empty. That’s right, 90% empty! And the reasons are telling!

But before examining the reasons, let’s first review where we left off in El Dorado — Part I… since it has been almost two months and nine other posts since I published it.

* * * * * * * * * *

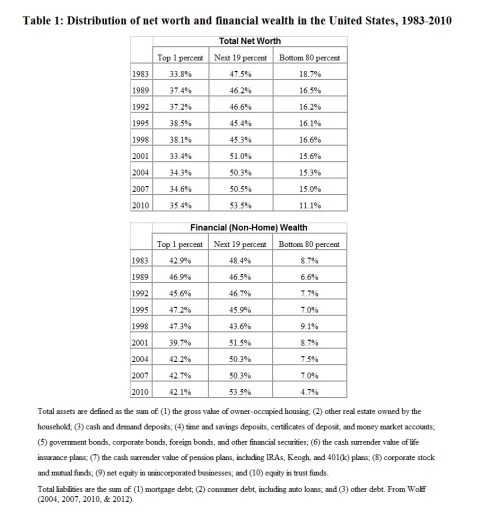

American workers between the age of 25-54 work an average 63 hours per week, 7 days a week, equating to almost 9-hours per day. Of all Western nations this work-rate is the highest among industrialized countries. This obsession to work looks like this: their 7-day work week earns them an average wage of $47,000 per year, or $14.35/hour and this wage often does not come with medical-health benefits from the employer — most American low-wage jobs don’t. Therefore, factor in that deduction from $14.35/hour and you only begin to see the real picture for much of the American workforce.

At the other end of the spectrum you have attorneys at-law, the highest wage-earners, making between $105,000 to $192,000 per year (in the 48 conjoined states) according to the American Bar Association 2011. This job-sector also has the nation’s highest rates of depression and suicide, along with American teachers, counselors, and executive assistants, respectively. What is more bewildering is that universities across the United States “report steady or increased enrollment into their law schools and medical schools, and not so surprising decreased enrollment into their schools of education and counseling.” The steady or increasing numbers to law schools and the declining numbers into teaching or counseling classrooms are directly related to their average salaries.

Fortunately, this subtle American tragic disunion has an upside… which I will get to momentarily.

Visions of World Grandeur

Accounting history has shown over the last two decades that to host a FIFA World Cup is extremely stimulating for a country’s economy, employment, its leadership, and world image. The spectacle of the four-week tournament includes 32 different nations and their raving fans, unimaginable TV exposure and revenues, exceptionally high tourism revenue, fan sites and events at each game just outside of stadiums, all-encompassing millions upon billions of dollars. Glitz, glamour, and metaphorical-gold abound! Not surprising, the bidding war for the 2022 World Cup was fierce between the U.S., Japan, and Qatar, with Qatar coming out as the highly controversial winner. As mentioned, Doha, the capital of Qatar, will host several of the games. The Qatari ruling family (Emirs, Faisals or Kings), the house of Al-Thani, began in 2010-11 implementing very bold construction plans for a “New Qatar” as a whole, but in particular the FIFA game-venues throughout the eastern portion of the country as the chance to awe not only the sports world, but the entire modern world after the games. Qatar shipped in thousands of foreign workers and erected several “Emerald Cities” the world would envy!

Why then, as of October 2014, is the capital Doha 90% empty?

BQDoha.com (Business Qatar) explains three primary causes and symptoms to Doha’s emptiness. One — overcrowded cramped housing. The average person, mostly foreign construction workers, live with other families or individuals in “villas” — many semi-dilapidated buildings — partitioned into family-sections in order that landlords turnover a bigger profit. Two — a wait-and-watch holdout policy by landlords for the foreign corporate residents. Landlords can better gouge big corporations for higher rent and get the rent in one lump sum for a 3-year contract on average. And Three — a saturation of aggressive street peddlers disguised as “real estate brokers” but paid by landlords discreetly. Rents quoted by these illegal peddlers are high to pad their finder’s fee and compensation. From these three causes follow symptoms of a city and nation struggling with traditions, expatriates, and modernism heavily pushed by the Emir and extremely wealthy faisal families-business élite. A quick read of The New York Times Middle East beat-writer Anthony Shadid’s November 2011 article, shows how the capital city, its nation and upper-elite, versus its common people are sharply contrasted behind the imposing Emerald City façade. Visions of world notoriety and wealth come only from a tiny privileged percentage of Qataris.

The United States has its fair share of Emerald Cities too: Detroit, Michigan and Cleveland, Ohio are two most notable emptying facades out of several.

Getting Behind the Glittering Veil

In Part I of El Dorado I touched on the highly clever, complex marketing schemes (Ponzi Schemes?) America’s upper 10% and corporate executives promote to consumers — extensive details of the schemes were found in five previous posts. But rather than hunting and gutting the schemers, I want to delve into the uneducated gullible consumer’s mind; why do they/we swallow El Dorado hook, line, and sinker? Why does one incessantly chase Emerald City citizenship with big eyes and panting breath? Probably five reasons:

- Values

- Goals/Dreams

- Respect of Peers

- Learned Skills

- Time and one’s concept of it

What do you value in life? What activities do you enjoy most? If you are unable to satisfy your value-systems, what goals or dreams do you have in order to work for and satisfy your values? Typically, we all value the respect of someone: our parents, spouse or intimate partner, coach or boss, a fan-base or maybe the approvals and recommendations of institutions or associations, like universities or writers guild. Everyone seeks some degree of respect from others. What skills or talents have you been taught? Are those skills considered excellent? Average? Evaluated by whom? Certainly everyone cannot be self-proclaimed tycoons, right? Therefore, respect and skills are irrevocably linked.

Perhaps the most significant reason one seeks El Dorado-Emerald City citizenship is their concept of time. In Western industrialized nations, the average lifespan is 78-years; for women 81-82 years. Depending on where you are born and to what parents may dictate how much time you have to obtain the coveted citizenship, march through the golden gates, and into worldly bliss. Then again, many believe existence does not end at 78 or 82 years. For them it might be eternal and as such feel much less pressure to pass through those gates — atheists and deists may not bother with citizenship-anxiety at all. Eat, drink, and be very merry might be all that matters to them — a lifestyle this Bohemian doesn’t scuff off but happily joins on several occasions!

Perhaps the most significant reason one seeks El Dorado-Emerald City citizenship is their concept of time. In Western industrialized nations, the average lifespan is 78-years; for women 81-82 years. Depending on where you are born and to what parents may dictate how much time you have to obtain the coveted citizenship, march through the golden gates, and into worldly bliss. Then again, many believe existence does not end at 78 or 82 years. For them it might be eternal and as such feel much less pressure to pass through those gates — atheists and deists may not bother with citizenship-anxiety at all. Eat, drink, and be very merry might be all that matters to them — a lifestyle this Bohemian doesn’t scuff off but happily joins on several occasions!

These five above appetites that hungry consumers have are well-known and pandered to by the Kings and Queens of El Dorado and Emerald City. Their accompanying marketing departments probably know even better. Fortune 100 companies pay millions, maybe billions, to the élite Top marketing firms or internal departments to CREATE insatiable consumer appetites! For a population that doesn’t have easy access to alternative lifestyles’ skills or services (such as, living off-the-grid), or the matching business-marketing masters degrees or PhD’s, the consumer’s future is an increasing metaphorical obesity epidemic. The gourmet chefs of this buyer buffet — the Fortune 100 or 500 businesses and executives — won’t ever stop crowding your table and plates with “masterpieces” unless you break the trance and walk away by your own will-power!

The New Tiny Living Tiny House Movement

The Wall Street Crisis of 2007-08 and to an extent America’s metaphorical appetite for obesity, jump-started the Tiny Living Tiny House Nation and Movement as an alternative to high-debt living and mortgages which greatly limit owner’s freedoms and R&R in a hectic ultra-competitive free-market economy. From 1978 to 2007 the average size of new single-family American home grew from 1,780 sq. feet to almost 2,500 sq. feet. With that growth followed all accessory businesses such as landscaping and home-improvement. By the time President Ronald Reagan finished his last term in 1989 and put into law his Tax Reform Act of 1986, the make-it-bigger home market fly-wheel was at full-speed-ahead until it hit the granite wall in 2007.

Today, on top of the purchase-price, down payment, principle paid, interest after-tax, taxes and home insurance, maintenance, and major repairs and/or improvements, the final amount out-of-pocket for a typical single-family home reaches over $1-million for a 30-year term. If you are the 76% – 90% portion of the typical American family earning between $35k – $50k annually, where is the fiscal wisdom in living so far out of your means?

The fantastic people at TheTinyLife.com offer home-buyers interested in more freedom, more time, more environmentally conscious, more fiscally responsible, just more modesty and simplicity for hectic lives by liberating themselves from America’s bigger-is-better GAUDINESS! It’s just smarter.

For most Americans 1/3 to 1/2 of their income is dedicated to the roof over their heads; This translates to 15 years of working over your life time just to pay for it and because of it 76% of Americans are living paycheck to paycheck.

— TheTinyLife.com

Please stop by their website to learn the brilliance in unburdening yourself from the modern home-building, home-improvement marketing schemes that imprison and overload many nose-diving Americans. Wise up!

Labor of Survival, Status, or of Love?

It is perhaps the most introspective questions we ask ourselves: Am I working to survive? Am I working to gain status? Am I not “working” because I love my job? In which group do you fall? In which one would you rather be?

Finding our bearings through these questions and possibly changing our heading in today’s labor and social environment can seem daunting. Marketing impulse-triggering wizards with million-dollar Ivy League business degrees

Finding our bearings through these questions and possibly changing our heading in today’s labor and social environment can seem daunting. Marketing impulse-triggering wizards with million-dollar Ivy League business degrees wickedly cleverly pull at our heart-strings. But the consequences of not checking your bearings and heading could prove to be much worse on one’s emotional, spiritual, and physical health. It would be wise to ask yourself at least twice a year, What am I laboring for and will it be worth it come retirement? For many Americans “retirement in luxury” is a distant fantasy due to a lifetime of survival mode and seemingly never-ending self-sacrifice. If this is the case, maybe a second and third question should be asked… Where is the majority of my paycheck(s) going? Are those credits bearing valuable fruit or evaporating, or padding a total stranger’s pocketbook?

Laboring for status is perhaps the greatest American trickster scheme. It can at first be mistaken for love. There’s no better example of this than in the top four U.S. sports markets. Coaches, General Managers, Athletic Directors, and finally the players (with the exception of NCAA collegiate athletes) face the very real possibility that their employment or their role will be terminated or replaced by another every year, sometimes less than a year! In the NFL (National Football League), the #1 most popular sport in America, a head coach lasts an average of 38-months. NFL General Managers last a bit longer at 44-months. In the MLB (Major League Baseball), the #2 sport in America, a Manager/Coach lasts about 24-months. And unless players in both the NFL or MLB are tagged franchise-players, they stay only 24-months on average with one team. Athletic Directors with NCAA Division I universities enjoy more stability and longevity at 7.5 years on campus, but over the last decade this average has steadily dropped due to collegiate sports (and revenues) becoming more widely competitive. There has also been increased mobility or transfers by NCAA football and baseball players for improved exposure to NFL and MLB scouts, especially in baseball given its now global appeal. In the NBA (National Basketball Association), the #4 most popular sport (along with auto-racing), staff and player positions and vacancies have become a near non-stop marry-go-round with replacements, no check that, scapegoats… with an average stay of only 9-months; the NBA season is only 6-months long.

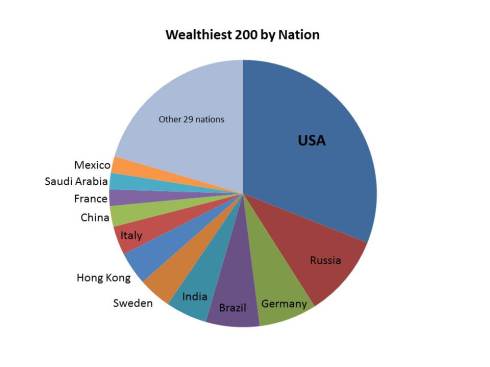

What does all this mean? In the American sports culture it means one thing: winning championships or very least, consistent playoff births. Status. Nothing else matters; truly a What-have-you-done-for-me-lately intolerance. Just how much does the American sports world permeate American occupational and economic culture? Answer: Factor in all games and events, merchandise, and other incidental sports activities, and the dollar figure goes easily into the upper billions! Yes, 60.9% of American sports fans, i.e. the men, fantasize and live vicariously through their favorite pro and collegiate athletes and spend royally to feel and look like them.

According to Forbes.com and NSGA.org (National Sporting Goods Association), every year Americans spend around $43-billion on retail sporting goods such as gear and equipment, logo’d-apparel of their team(s), not counting game or season tickets. Sports gambling, e.g. fantasy leagues, rake in $20-billion from American sports fans in a $400-billion dollar sports gambling industry. Parents of little American athletes spend $300-million a year for various league registrations, uniform fees, etc, then the figure leaps to $900-million per year for goods, incidentals, and travel for their athletic kids. Let’s not forget how much companies spend on TV advertising, and fans on Pay-per-View events; that figure is in excess of $10-billion per year.

Those dollar figures beg many serious questions, not the least of which is why do American taxpayers bitch and whine about taxes and tax-levels, the national deficit, poorly run government programs, and struggling public infrastructure when clearly the private sector, i.e. businesses and individuals, spend over $474-billion dollars PER YEAR on sporting entertainment alone? Should I remind us of what those same entities spend on real estate, homes, home-improvement, home accessories, and automobiles to park in the two-car garages? No? Then at least remember $474+ billion dollars annually just on entertainment.

A laboring of love is generally accepted, or should be, as the way to live. Though by the time I reached my 30’s or 40’s, with a marriage or two, and then children — you know, after all the trials and tribulations getting through my teens and twenties — the light-bulb didn’t come on…I was halfway finished with my life! Time to get serious and ask myself those hard questions. I won’t bog you readers down with another convincing argument (wink) of why a life of experience, experience with others, with the ones you care for deeply and go through thick-n-thin with to come out singing and dancing… is the way to go. No, I hope all of you can grasp and understand what Albert Einstein profoundly distinguished:

“Strive not to be a success, but rather to be of value.”

— Albert Einstein

For those who might need a hint, Dr. Albert distinguished two opposite concepts in just those twelve simple words. The first-hand experience to love and be loved is the best labor in life, not status or success. I would add to Einstein’s point that modesty and moderation will limit, even save one from the dangers and risks of metaphorical and yes, literal obesity.

These are very difficult concepts to execute for many Americans because we are surrounded and bombarded by remade patriotic 19th and 20th century cheers of Seek in earnest El Dorado and you will find and sit on its throne. But the more feasible reality involves your immediate and intermediate circles of influence and experience. Beyond those lines, beyond those outlands are the experiences and lives meant for others, not just you. Everyone has a “sandbox” to build and play inside, but the walls enclosing your sandbox should never be inflexible nor perpetually expanding or worse, imperializing. Am I saying humanity as a whole should not collaborate for an improved more healthy sustainable self and planet? Not in the least, no. However, if every single human is supposed to build their own El Dorado, then it seems to me we will all manifest Aristotle’s fabled King Midas of Phyrgia turning everything, including ourselves, into unsustainable useless gold with 7.4 billion King Midas’s running around atop 7.4 billion useless thrones ruling an unsustainable golden rock-planet of 7.4 billion useless Phyrgia kingdoms! One fashion color and one fashion color only! One texture and one texture only! One food group and one food group only! Eeeeek…

Is that the life on El Planedo you want to live?

(paragraph break)

Live Well — Love Much — Laugh Often — Learn Always

(paragraph break)

Blog content with this logo by Professor Taboo is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

Permissions beyond the scope of this license may be available at https://professortaboo.com/.